Asante Gold Corporation has announced the filing of its audited financial statements and management’s discussion and analysis for the three months and fiscal year ended January 31, 2024.

A summary of the financial and operating results for fiscal 2024 are presented in this news release, together with an outlook for the Bibiani and Chirano mines.

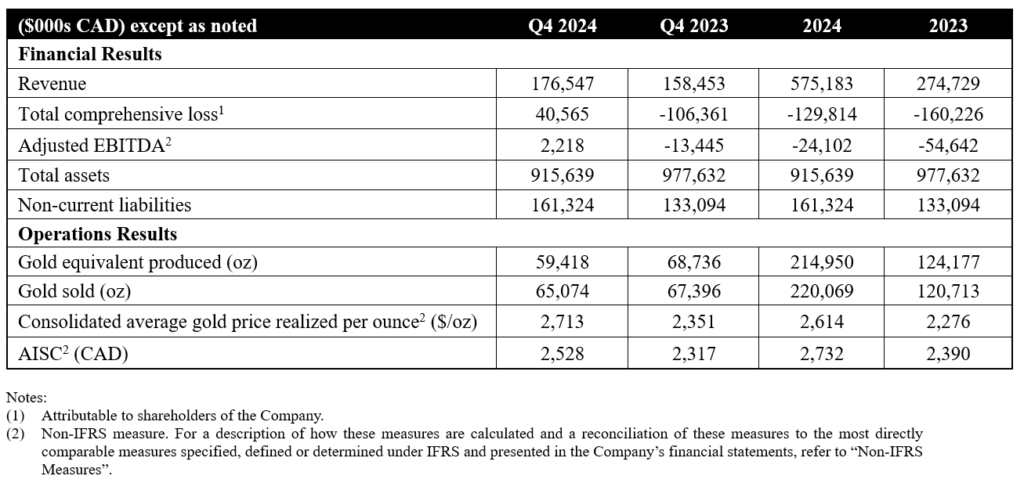

FY2024 Summary Financial Results

Asante’s revenue in FY2024 was $575 million, a 109% increase from $275 million in the prior fiscal year, primarily reflecting a full year of production at both mines.

This compares to approximately 6 months of production results at each mine in FY2023 post first gold pour at Bibiani in July 2022 and the acquisition of Chirano in August 2022.

Consolidated gold production in FY2024 totaled 214,950 ounces, a 73% increase relative to FY2023. The Company reported total comprehensive loss attributable to shareholders of the Company of $130 million relative to $160 million in the prior fiscal year.

In Q4 2024, the Company achieved positive adjusted EBITDA and comprehensive income for the first time, positively impacted by a higher realized gold price and reversal of provisions.

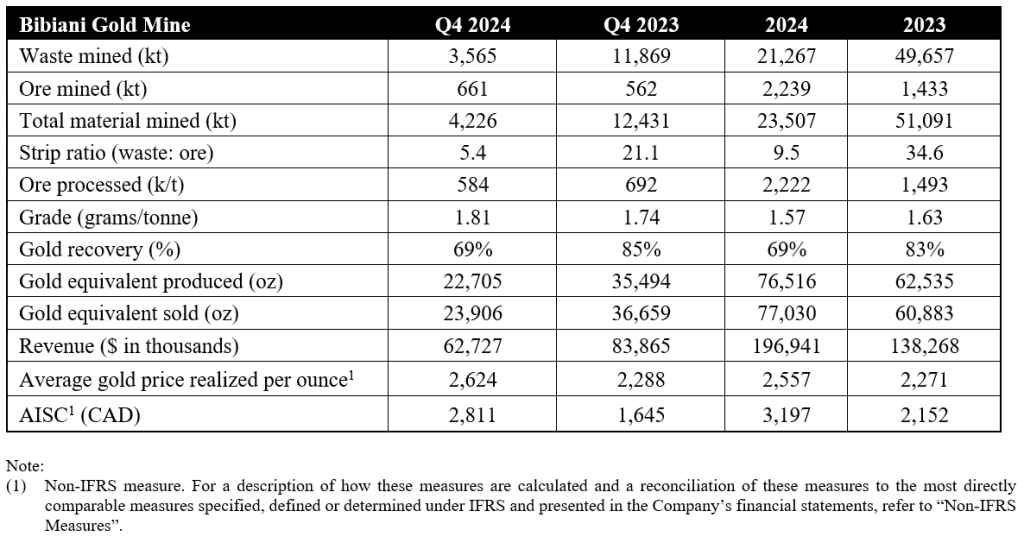

Bibiani Mine – Summary of Q4 & FY2024 Results

In FY2024, gold equivalent production increased 22% to 76,516 ounces, primarily reflecting the inclusion of twelve months of operating results in FY2024 relative to approximately six months in FY2023.

In the months following first gold pour at Bibiani in July 2022, mined and processed ore was primarily oxide material. As a result, notwithstanding several plant upgrades that were not yet completed in 2023, gold recovery of 83% was achieved.

However, as the mining sequence at the Bibiani main pit continued into FY2024, access to oxide ore below the Goaso highway was delayed. Progressively more sulphide material was mined which required a sulphide treatment plant to optimize gold recovery. Due to lack of capital funding, the Company was unable to complete this planned project in FY2024 and gold recovery consequently decreased below 70%.

Concurrently, lower contractor equipment availability as a result of liquidity constraints negatively impacted mining capacity. These factors were the primary drivers of an increase in AISC from $2,152 per ounce in FY2023 to $3,197 per ounce in FY2024.

Results for Q4 2024 continued to be impacted by the aforementioned factors, resulting in reported gold recovery of 69% and AISC of $2,811 per ounce.

Bibiani Mine – Outlook

On April 30, 2024, the Company filed an updated NI 43-101 technical report for the Bibiani mine (the “Bibiani 2024 Technical Report”), with highlights as follows:

- Gold production of 271koz in FY2026 (254% increase over FY2024), enabled by FY2025 investments in the main pit expansion in FY2025 and a sulphide treatment plant to increase gold recovery to 92%

- Commencement of underground mine development in 2025 with first underground ore processed in FY2027; a robust mine plan is underpinned by first-ever underground reserves delineated by Asante

- Significant unit cost reduction by FY2026 reflecting reduced stripping requirements, increased scale, and increased gold recovery; AISC projected to be under US$1,100/oz by 2027

- 2.5 million ounces of measured and indicated resources at a grade 2.30g/t gold, a 9% increase compared to the previous technical report, reflecting underground strategy with over 0.9 million ounces of underground reserves

- 1.2 million ounces of inferred resources at a grade of 2.36g/t gold, a 225% increase compared to the previous technical report

The Bibiani mine plan as outlined in the Bibiani 2024 Technical Report is based on proven and probable reserves only, without inclusion of the significant incremental resource base. The Company’s strategic planning envisages the potential for production increases and mine life extension based on continued resource conversion and exploration success.

Consistent with the Bibiani 2024 Technical Report and subject to availability of financing, the Company expects production of 110,000 to 120,000 gold equivalent ounces in FY2025 based on successful execution of the following initiatives:

- Cutting the Bibiani-Goaso National Highway

- Execution of the second cutback of the main pit as envisaged in the Bibiani 2024 Technical Report

- Progression of community relocation and road construction activities

- Construction and commissioning of the sulphide treatment plant by Q4 2025

- Other plant upgrades including installation of a pebble crusher by Q2 2025, completion of the scalping screen supporting the gravity plant, and upgrades and expansions of the CIL and elution facilities

- Development of a starter pit at the South Russell project to supplement ore feed from the main pit

Consistent with the Bibiani 2024 Technical Report, the Company expects that execution of these initiatives will also result in significant increase in production and decrease in costs beyond fiscal 2025.

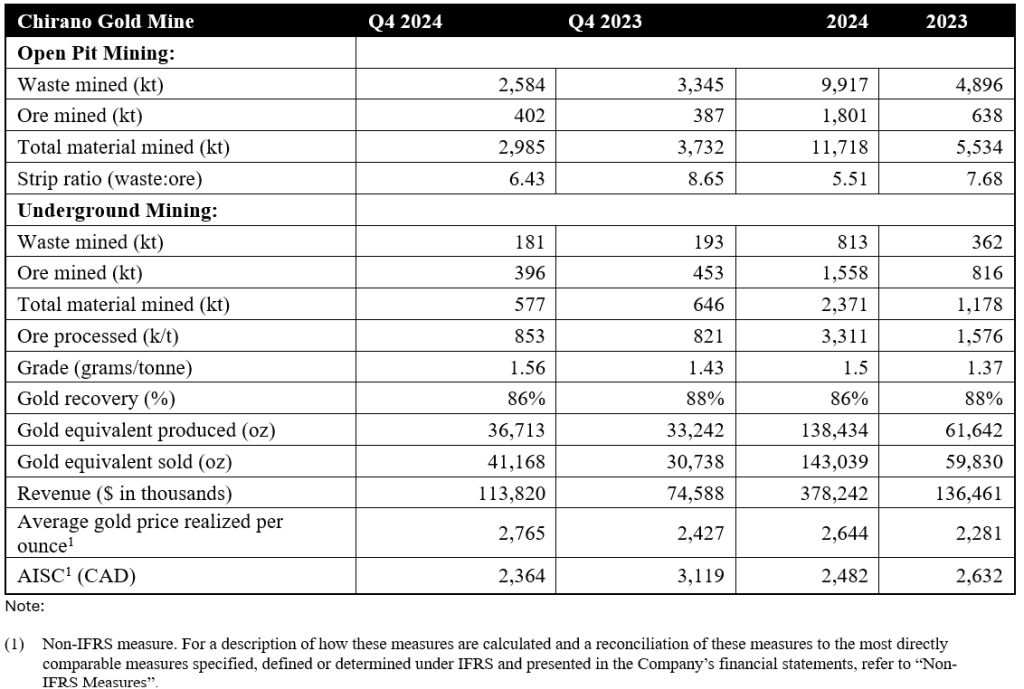

Chirano Mine – Summary of Q4 & FY2024 Results

For the full year, the increase in gold equivalent production from 61,642 ounces in FY2023 to 138,434 ounces in FY2024 primarily reflects the inclusion of twelve months of production in FY2024.

Chirano was acquired by the Company in August 2022 and therefore the prior period represents approximately six months of operations.

To improve plant recovery and throughput, a gravity plant was completed and commissioned in November 2023 and an oxygen plant was constructed in December 2023. For the full year, AISC decreased to $2,482 per ounce in 2024, positively impacted by improved grades.

Results for Q4 2024 include a 4% increase in gold equivalent production to 36,713 ounces driven by a 4% increase in ore processed and a 9% increase in processed grade to 1.56g/t as a result of higher grades mined from the Suraw and Obra underground mines.

The decrease in AISC from $3,119 per ounce in Q4 2023 to $2,364 per ounce in Q4 2024 benefitted from increased gold sales, ore processed and higher grades.

Chirano Mine – Outlook

On April 30, 2024, the Company filed an updated NI 43-101 technical report for the Chirano mine (the “Chirano 2024 Technical Report”), with highlights as follows:

- Gold production of 178koz in 2025 (a 28% increase over 2023) and exceeding 200koz by 2027

- Underground mine plan focused on expansion of the Obra and Suraw mines

- Lower unit costs from 2025 from increased throughput, efficiencies, improved use of capital

- 2.1 million ounces of measured and indicated resources at a grade of 1.63g/t gold, an 84% increase vs. the previous technical report

- 1.0 million ounces of inferred mineral resources at a grade of 1.60g/t gold, a 177% increase vs. the previous technical report

The Chirano mine plan as articulated in the Chirano 2024 Technical Report is based on proven and probable reserves only, without inclusion of the significant incremental resource base. The Company foresees the potential for production increases and mine life extension based on continued resource conversion and exploration success.

Consistent with the Chirano 2024 Technical Report and subject to the availability of financing, the Company expects production of 160,000 to 170,000 gold equivalent ounces in fiscal 2025.

Near-term initiatives in 2025 include:

- Installation of an Aachen Reactor to enhance leaching kinetics by the end of Q1 2025

- A pebble crusher has been procured and installed on schedule, and throughput capacity has increased from 3.4Mt/y to 3.6Mt/y. Further primary grinding upgrades, CIL upgrades, pump upgrades and cyclone replacement are planned to be operational from Q4 2025 with the aim of increasing process plant throughput capacity from 3.7Mt/y to 4.0Mt/y

- Completion of the second cutback at the Sariehu open pit

- Replacement of the Mamnao central and south pits with Sariehu, Mamnao north and Obra in Q1 2025

Management expects these initiatives will provide access to incremental resources with the ultimate strategy of efficient blend of open pit and underground ore to ensure control of head grade.

Qualified Person Statement

The scientific and technical information contained in this news release has been reviewed and approved by the Qualified Persons (as defined under NI 43-101) and authors of the Technical Report, David Michael Begg of dMb Management Services Pty Ltd (South Africa), Clive Brown of BARA International, Galen White of Bara Consulting UK Limited, Glenn Bezuidenhout of GB Independent Consulting Pty Ltd, and Malcolm Titley of Maja Mining Limited.

None of the Qualified Persons hold any interest in Asante, its associated parties, or in any of the mineral properties which are the subject of this news release.

Other scientific and technical information contained in this news release has been reviewed and approved by David Anthony, P.Eng., Mining and Mineral Processing, President and CEO of Asante, who is a “qualified person” under NI 43-101.

Non-IFRS Measures

This news release includes certain terms or performance measures commonly used in the mining industry that are not defined under International Financial Reporting Standards (“IFRS”), including “all-in sustaining costs” (or “AISC”), average gold price realized, adjusted EBITDA and working capital.

Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies.

The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS and should be read in conjunction with Asante’s consolidated financial statements.

Readers should refer to Asante’s Management Discussion and Analysis under the heading “Non-IFRS Measures” for a more detailed discussion of how Asante calculates certain of such measures and a reconciliation of certain measures to IFRS terms.